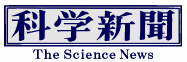

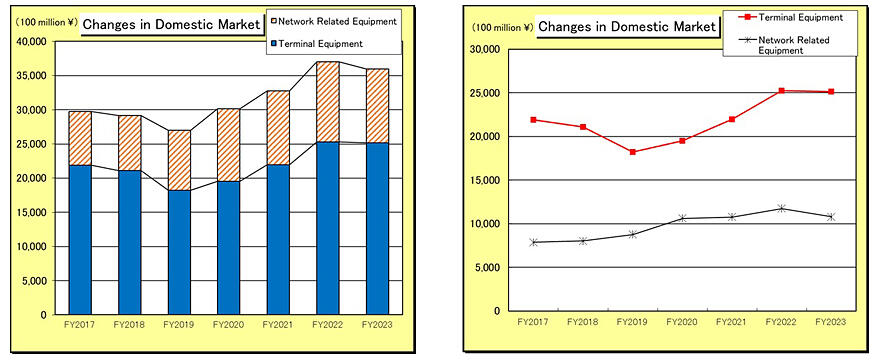

On June 12, the Communications and Information Network Association of Japan (CIAJ) released its annual report on the general trends of telecommunications equipment production, imports, and exports for fiscal year 2023 (April to March). Japan's real GDP grew, albeit at a low rate, to post positive growth for the third consecutive year. However, the domestic telecommunications equipment market value (domestic production value - exports + imports: excluding parts), domestic production, exports, and imports were all down from the previous fiscal year, totaling 3.5948 trillion yen, a 2.9% decrease from the previous fiscal year.

Source: CIAJ

In fiscal year 2023, the Japanese economy continued to see sluggish personal consumption, but external demand, such as an increase in exports due to the easing of semiconductor supply constraints and a recovery in inbound demand, drove real GDP growth (second preliminary figure: June 10th) at 1.2% higher than the previous fiscal year, marking a third consecutive year of positive growth, albeit at a low rate. In this context, the domestic telecommunications equipment market saw a recovery in business equipment for offices due to increased corporate activity. However, the domestic market value of network-related equipment declined for the first time in seven years because of the sluggishness in digital transmission equipment and base stations, resulting in the first year-on-year decline in the domestic market as a whole in four years. By device, the terminal equipment market decreased by 0.5% to 3.5148 trillion yen and the network-related equipment market decreased by 8.1% to 1.0800 trillion yen, resulting in an overall decrease from the previous fiscal year. Domestic production totaled 389.1 billion yen, down by 20.0% for the fourth consecutive fiscal year. Wired terminal equipment increased as the impact of recovery of supply constraints. However, land mobile communications equipment, including cell phones, which continued to see domestic manufacturers withdraw from the business, declined sharply, and domestic production also fell sharply.

Total exports fell for the first time in three years to 322.8 billion yen, down by 9.8% from the previous fiscal year. Exports of network-related equipment associated with increased traffic, increased due to the weaker yen. However, total exports decreased due to a decline in components for smartphone production resulting from a depressed global market, including China, where smartphone shipments continue to decline due to contract saturation and economic stagnation.

Total imports also decreased for the first time in four years to 3.5825 trillion yen, down by 0.8% from the previous fiscal year. Although the imports of cell phones decreased due to the extended replacement cycle, the import value increased due to strong sales of high-priced models made by foreign manufacturers. However, total imports decreased due to declining domestic investment in telecommunications infrastructure equipment. Export and import trends were compiled by CIAJ from Ministry of Finance trade statistics. Among them, according to export trends, countries with the highest export value of cell phones are the U.S., Hong Kong, UAE, Taiwan, and Vietnam. In fiscal year 2023, exports of cell phones to countries other than the U.S. increased. However, the exports of cell phones decreased overall due to a decrease in the exports to the U.S.

With regard to parts (the total of wired and wireless systems), the exports to China and the U.S. significantly declined, and the overall exports declined for the first time in three years. The reason is that smartphone production, which had been recovering after the COVID-19 pandemic, was sluggish worldwide.

By region, exports to Asia accounted for the largest share of 160.5 billion yen (down by 8.1% from the previous fiscal year), of which 59.8 billion yen (down by 22.2% from the previous fiscal year) went to China. This was followed by sales to North America at 101.6 billion yen (down by 24.7% from the previous fiscal year), of which 98.5 billion yen (down by 25.5% from the previous fiscal year) was for the U.S.

Sales to Europe increased to 47.1 billion yen (up by 23.8% from the previous fiscal year). Of this amount, the EU grew to 37.9 billion yen (up by 25.4% from the previous fiscal year). Due to a significant decrease in cellular phones and base stations, exports to the U.S. declined. However, it exceeded to that of China for the third consecutive fiscal year.

As a result, by region, Asia ranked first with 49.7% of exports (up by 0.9% from the previous fiscal year), followed by North America with 31.5% (down by 6.2% from the previous fiscal year), Europe with 14.6% (up by 4.0% from the previous fiscal year), and other regions with 4.2% (up by 1.3% from the previous fiscal year).

Import trends show that imports of telephones and terminal equipment grew to 2.3857 trillion yen (up by 1.2% from the previous fiscal year). This figure can be broken down into 2.3738 trillion yen for cell phones (up by 1.2% compared to previous fiscal year), 4.9 billion yen for cordless phones (down by 1.5% compared to previous fiscal year), and 7.0 billion yen for others (down by 4.7% compared to previous fiscal year).

Demand for cell phone imports is sluggish due to extended replacement cycles. Imports of units made by domestic and foreign manufacturers produced overseas decreased. However, the value of imports increased due to strong sales of high-priced models made by foreign manufacturers and the weak yen. Production of cordless phones has also stabilized as the shortage of supply of parts at overseas factories has been resolved.

Imports of network-related equipment decreased to 1.0238 trillion yen (down by 4.2% from the previous fiscal year). This figure can be broken down into 32.9 billion yen for base stations (down by 47.0% from the previous fiscal year), 96.33 billion yen for data communication equipment (down by 1.8% from the previous fiscal year), and 27.5 billion yen for other network-related equipment (up by 8.5% from the previous fiscal year). Imports of base stations from Asia and the U.S. dropped sharply as telecommunications carriers continued to curb investment in domestic facilities.

Imports by region in fiscal year 2023 totaled 3.3808 trillion yen (down by 1.8% from the previous fiscal year), majorly coming from Asia. Of this amount, 2.6781 trillion yen (down by 2.5% from the previous fiscal year) came from China. This was followed by 83 billion yen from Europe (up by 34.6% from the previous fiscal year), of which 79.4 billion yen came from the EU (up by 37.9% from the previous fiscal year), and 65 billion yen from North America (up by 6.0% from the previous fiscal year), of which 58.6 billion yen came from the U.S. (up by 5.6% from the previous fiscal year).

As a result, Asia ranked first with 94.4% of imports (down by 1.0% from the previous fiscal year), followed by Europe with 2.3% (up by 0.6% from the previous fiscal year), North America with 1.8% (up by 0.1% from the previous fiscal year), and other regions with 1.5% (up by 0.2% from the previous fiscal year).

The CIAJ tabulates orders and shipments (domestic shipments + exports = domestic production + imports produced overseas) of its member Japanese manufacturers. The actual number of orders and shipments in fiscal year 2023 was 1.1695 trillion yen (down by 25.5% from the previous fiscal year), a significant decrease even on an orders and shipments basis. Of this amount, domestic shipments totaled 941.4 billion yen (down by 20.0% from the previous fiscal year), whereas exports totaled 228.1 billion yen (down by 42.1% from the previous fiscal year), a decline in both figures.

This article has been translated by JST with permission from The Science News Ltd. (https://sci-news.co.jp/). Unauthorized reproduction of the article and photographs is prohibited.